The word start-up

has caught up trend from year 2014 when government announced their special

program i.e. Start-up India. However, despite of over 6 years, there is lack of

understanding and lack of awareness in minds of people for start-ups. What

exactly qualifies for start-up? How and when funding takes place? and How a

start-up grows?

Before understanding business and fundamentals of business building, one must understand the journey of a Startup Company. Like a human is born and grows through lifecycle of childhood, adolescent, adult age and old age, start-up also has four life cycles. However, there is a major difference between human life and life of a start-up i.e. human life has fixed pattern of growth and time associated with each cycle. In case of a start-up the growth is completely dependent on product, technology, timely funding and execution of proper business plan.

The life of start-up has four major components i.e. Ideation, Validation, Early Traction and Scaling. Each of this stage needs to be crossed with utmost care and proper planning. Let’s have a look on each stage to understand in detailed.

1] IDEATION: This is inception point for a start-up. It’s the point where a business idea is born and a decision to become an entrepreneur is taken by the Founder. In Ideation phase the Idea is in its raw form and needs lot of fine tuning and incubation. It’s ideal phase for founder to get associated with the expert mentors in the respective field and get the idea defined. This mentoring has various aspects and involvement. Some of the major aspects of defining and fine-tuning start-up are

·

Identifying Technical feasibility

·

Identifying commercial scalability

·

Identifying possibility for recognition as innovation / patent etc

·

Identifying potential for employment generation

·

Identifying competition

·

Identifying Business plan, funding opportunities

·

Identifying right form of business and company structure. Etc.

For a

successful start-up its important that the idea on which stat-up is working is

capable to providing solution for problems faced by either a specific sector of

society or society at large. The gap analysis to identify problems is very

important for any startup to have a valid idea. If we look at recent successful

start-ups like Swiggy, Zomato, Ola, Oyo etc, we can see that all these

start-ups are having a perfect gap analysis of demand and these startups came

up with cost effective solution for that market gap.

2] VALIDATION: Validation phase is the stage in which the idea is validated and a concrete decision about foundation of the company is taken. It is the phase where testing of Idea happens with lots of parameters. In this stage of product or service, beta version of the product is launched and put to test. This testing can happen by multiple ways. Most common method is launch of pilot project and deploying that product to select group of people, who can use the same and identify the shortcomings while using that product. In this phase, lot of re-work happens and functional changes possible. If group of people, who are testing are meticulous in using that product, then there are very high chances that the product will undergo tremendous amount of changes and improvement.

In the validation stage it is not only the validation of the product, but it has got 2 more aspects associated with it. Firstly, validating your customer and secondly validating business processes, SOPs, human resource, finance and business plan associated with the startup. In Customer validation, Start-up fine tunes the exact category of the customer, who can buy product from him, his age group, his income group, his social status, his financial status, his buying behaviour and frequency. And in the process validation, startup identifies delivery system, service mechanism, financial aspects, credit system, HR, management decision making and hierarchy, a revised business plan based on costing and projections.

After a successful validation of the idea, the start-up is ready for mass production and take in big leap in the lifecycle. We can say that, at this stage the Start-up has reached its maturity and now the real work and business begins.

3] Early Traction

Early traction is stage where Startup goes for building it customer base rapidly. Here starts the hunting process to acquire market share and creating presence for the brand for products or services of the startup. In order to pass this stage various factors contribute, such as quality of the product, branding, advertisement, service quality, customer feedback and satisfaction and reaching to masses.

When you think of branding, you automatically have visions of logos, voice and tone, website design and social media presence. But in my opinion "Brand is the experience that your customers feel". It is Identified that the branding is much more than only name of the product. Major components that are part of branding now days are design, graphics, color combination and graphology behind it.

Some products purely gain success just because they have an amazing packaging. One of the leading example of this is Paper Boat, a company in organic fruit juices. Packaging in case of product and experience in case of service are most important and major component in success of the startup and its early traction in the market.

4] The Big Game – Scaling up

This is the last stage for any Start-up and here starts the big game. Here starts last push to propel the shuttle of startup to leave behind gravitational force of competition and acquire global market and fly beyond infinity.

At this stage of lifecycle, startup looks for funding and raising capital by way of equity or debt fund arrangement. At this stage venture capitalists come into picture. The entry and success of this stage is largely dependant upon the founders and their team. The team here needs to be highly motivated and each department of the company needs to be led by highly competent, decision maker and dynamic leaders. Success of this stage is dependant upon how perfectly the start-up company is structured, how the board of directors are working and proper departments are in place. Each department of the company should comprise of A class employees and its should be led by a competent CEO having terrific vision and man management skills.

Here the Company must have a valid business plan. And Business plan does not means how much revenue company will be going to earn or by what time it will hit break even point or what will be valuation of the company after 1st, 2nd, 3rd, 4th & 5th year. It has got a deep insight which starts from vision and it ends on corporate governance and culture that the start up going to give to society.

It is my personal opinion that in order to excel at this stage and be a success, start-up needs to have a defined road map rather than a business plan. This road maps can have flexibility of adopting to en route changes.

·

There should be clear cut defined management hierarchy at each

stage of growth.

·

Defined KRA & KPI of all employees

·

Cash flow management

·

Projected budget of all expenses and losses.

·

A realistic view on profitability and expenses and ratio analysis

of the same.

·

A clear vision of all red flag situations.

·

All founders contracts and key employee contracts.

·

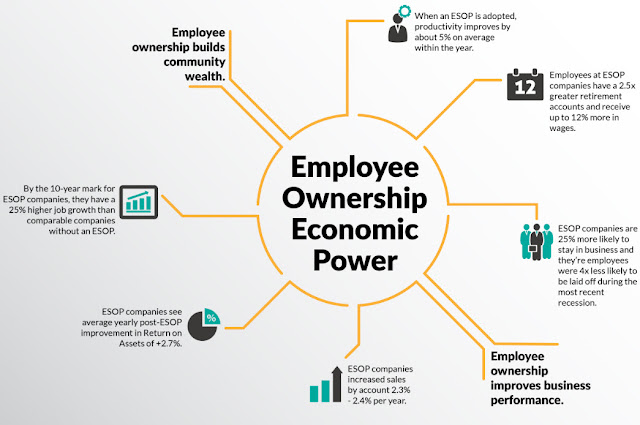

ESOPs and related schemes.

·

Territory based business development plan.

·

Hiring of the employees should be based on proper JD and Key

result areas where they are expected to deliver.

·

A clear vision on department wise upgradation in terms of

manpower, technology, system, ERP and targets.

·

Alignment of all departments.

·

A deep and intense study of market and competitors and most importantly it is done by a verified, professional & trusted agency.

If we see any growing startup we will find these elements present in that company. If we see Infosys, TCS, Tata Motors, Mahindra or start ups such as Swiggy, Zomato, Airbnb, Zoom etc we can see that all there companies have lived through this journey of start-up lifecycle.

As I quoted earlier this life cycle of the startup is not like human life cycle. It has got no fixed time associated with each stage. It is the vision, passion and uniqueness of the product that decides the pace at which the startup is going to go to multi- billionaire’s club or to ashes.

It’s not a 100 meter solo run but a 100*4 i.e. 400 meters relay race. Each stage has a key player. That player must perform his role perfectly and hand over the batten to next player of next 100 meter. If each player excel, the victory is your.

By CS Sushant Kulkarni

FCS, B.S.L., DADRS, DCL, LL.M.

(International Commercial Laws)

📱 9763663156

Email:

Sushant.kulkarni@arkscs.com

https://www.linkedin.com/in/cs-sushant-kulkarni-33031274/